We reported back in February that the Maryland legislature was considering a bill that would increase the minimum amount of MAIF insurance for uninsured drivers to $30,000 (Not Fair: Maryland Law Makes You Carry $30,000 Auto Insurance, But You Might Have a Maximum $20,000 Recovery).

We reported back in February that the Maryland legislature was considering a bill that would increase the minimum amount of MAIF insurance for uninsured drivers to $30,000 (Not Fair: Maryland Law Makes You Carry $30,000 Auto Insurance, But You Might Have a Maximum $20,000 Recovery).

The problem was that just over a year ago, the minimum amount of automobile insurance for all Maryland drivers was $20,000 per person and $40,000 per accident. Those minimums have been in place for over 35 years, and they were increased to $30,000 per person and $60,000 per accident. The law that increased the amount recoverable for Maryland automobile accident victims was missing one thing, though. It forget to mention the uninsured division of MAIF.

MAIF (Maryland Automobile Insurance Fund) is the insurance company of last resort for drivers who are rejected by most other insurance companies. They insure the uninsurable. MAIF also performs another function–when someone is involved in a Maryland automobile accident with someone who does not have insurance, or in a hit-and-run accident, MAIF will step in to help. They don’t step in voluntarily–usually it takes a lawsuit, but if there is no other insurance available, MAIF will cover the accident up to the minimum amount. Even after the 2011 change, MAIF was still only on the hook for $20,000/$40,000.

This post won’t go into detail about whether you can or should handle a Maryland auto accident lawsuit by yourself–that’s a post for a different day (for information about filing a lawsuit on your own, see the legal Self-Help section of our website).

This post won’t go into detail about whether you can or should handle a Maryland auto accident lawsuit by yourself–that’s a post for a different day (for information about filing a lawsuit on your own, see the legal Self-Help section of our website). Maryland Car Accident Lawyer Blog

Maryland Car Accident Lawyer Blog

We’ve had a spate of referrals from out-of-state lawyers lately that involve

We’ve had a spate of referrals from out-of-state lawyers lately that involve  In Maryland auto accident claims, the victim of a negligent driver is entitled to recover the cost of all reasonably related medical expenses. For example, if a driver runs a red light and hits another vehicle, the emergency room visit for the other vehicle’s occupants should be paid by the negligent driver’s insurance company.

In Maryland auto accident claims, the victim of a negligent driver is entitled to recover the cost of all reasonably related medical expenses. For example, if a driver runs a red light and hits another vehicle, the emergency room visit for the other vehicle’s occupants should be paid by the negligent driver’s insurance company.  As far as punishment, some believe that higher fines will increase compliance, just as it did for seatbelt laws. New Jersey is considering a $200 fine for the first offense with a license suspension for 90 days for the third offense. Connecticut has already increased fines to $125 for a first offense. In Maryland, the fines are relatively light. Talking on a cell phone can cost $40 for a first offense and $100 for subsequent offenses. Sending or reading e-mails or texts is punishable by $70 fine for the first offense and $110 for subsequent offenses.

As far as punishment, some believe that higher fines will increase compliance, just as it did for seatbelt laws. New Jersey is considering a $200 fine for the first offense with a license suspension for 90 days for the third offense. Connecticut has already increased fines to $125 for a first offense. In Maryland, the fines are relatively light. Talking on a cell phone can cost $40 for a first offense and $100 for subsequent offenses. Sending or reading e-mails or texts is punishable by $70 fine for the first offense and $110 for subsequent offenses.  Insurance is complicated business, and many of our auto accident clients get a crash course in coverage only after the collision. One common question from people involved in Baltimore auto accidents is whether there is insurance coverage for their

Insurance is complicated business, and many of our auto accident clients get a crash course in coverage only after the collision. One common question from people involved in Baltimore auto accidents is whether there is insurance coverage for their

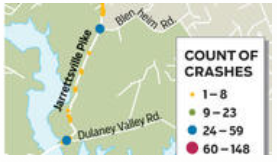

One small stretch of road in Baltimore County is claiming more lives than it should. Auto accidents on Jarrettsville Pike in Phoenix, Maryland are averaging two per week, with 73 injuries in three years. There was one death in 2008, and four deaths this year.

One small stretch of road in Baltimore County is claiming more lives than it should. Auto accidents on Jarrettsville Pike in Phoenix, Maryland are averaging two per week, with 73 injuries in three years. There was one death in 2008, and four deaths this year.  Most auto accident lawyers hate filing MAIF claims. First, there are a lot of hoops to jump through, including a 180-day notice requirement that, if not met exactly, can capsize the entire claim. Second, MAIF uninsured claims are limited to $30,000 per person and $60,000 per accident (

Most auto accident lawyers hate filing MAIF claims. First, there are a lot of hoops to jump through, including a 180-day notice requirement that, if not met exactly, can capsize the entire claim. Second, MAIF uninsured claims are limited to $30,000 per person and $60,000 per accident (